If you’re like most people, you’ve probably seen the Head and Shoulders Pattern at some point in your life. It’s a stock market pattern that can be used to predict how the market is going to move in the future. In this article, we’re going to take a look at the Head and Shoulders Pattern and see if it can help us make predictions for the stock market.

What is the Head and Shoulders Pattern?

The Head and Shoulders Pattern is a stock market technical analysis pattern that consists of two upward pointing peaks, followed by a downward trend. The pattern is most commonly found in the indexes of companies with a large amount of headroom (room to grow their earnings).

When to Expect the Head and Shoulders Pattern

The Head and Shoulders Pattern is a technical analysis indicator that can help traders anticipate when a stock is about to experience a price increase or decrease. The pattern consists of two parallel lines on the chart, which signal that investors are optimistic about the future direction of the stock.

To identify the Head and Shoulders Pattern, begin by studying the daily price movement of the stock. If you notice that the price has been trading in a narrow range for an extended period of time, chances are high that the market is anticipating a price change. Once you have identified a price range that is being tested frequently, look for two parallel lines to form on the chart. The closer the lines are together, the more bullish investors are feeling about the future of the stock.

Once you have identified a potential Head and Shoulders Pattern, it is important to stay vigilant. This pattern can often result in sudden price changes, so it is important to have your trading strategy in place should prices move in your favor.

How to Trade with the Head and Shoulders Pattern

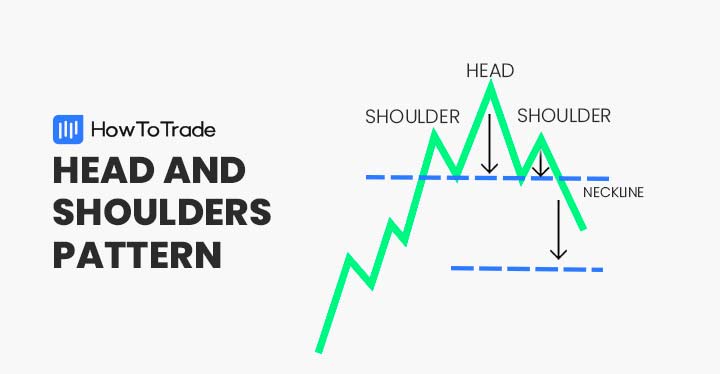

The head and shoulders pattern is a technical indicator used to identify when a stock is about to experience a price increase. The pattern consists of two candles that are shaped like the head and shoulders of a human, with the body of the candle indicating the current price and the shoulders representing the high and low prices from the previous candle. When these two prices are within 1/2 standard deviation of each other, it is considered to be in the head and shoulders pattern.

Head and shoulders

The head and shoulders pattern is a stock market technical indicator that reflects the strength of the U.S. equity market. The indicator consists of two lines, the upper one representing the prices of stocks in the S&P 500 Index, and the lower one representing the prices of stocks in the Russell 2000 Index. The pattern is created by combining the closing prices of these two indices over a certain period of time.

The indicator is used to identify periods of strong equity market performance and to identify overvalued or undervalued markets. When the head and shoulders pattern is formed, it indicates that there is a strong upward movement in prices for stocks in the S&P 500 Index and a weaker movement in prices for stocks in the Russell 2000 Index.

Inverse head and shoulders pattern

What is the head and shoulders pattern?

The inverse head and shoulders pattern is a bullish chart formation that occurs when the price of a security rises above the head of the pattern and then falls below the shoulders. The pattern is considered to be bullish because it suggests that demand for the security will continue to increase.

Head and shoulders pattern

The head and shoulders pattern is a stock market technical analysis signal that indicates that the market is about to experience a rally. The pattern consists of a series of higher highs and higher lows, followed by an upward trend. The pattern is most often identified in the stock market following an extended period of sideways movement.

Head and shoulders pattern target

When you are looking to trade the head and shoulders pattern, it is important to understand what it is. The head and shoulders pattern is a technical indicator that is used in order to identify stocks that are oversold and may be headed for a long-term rebound.

The basic idea behind the head and shoulders pattern is that there are two stocks that are separated by a higher price point. The first stock has been rising faster than the second stock, and this has created an ” upside head” (the taller of the two heads). The second stock has also been rising, but not as fast, and this creates the “shoulders” (the lower of the two shoulders).

As long as the two stocks remain separated by a higher price point, the pattern is considered valid. If one of the stocks begins to rise above the other, then the head and shoulders pattern has been broken and investors should avoid buying into the stock until it returns to its original position.

Head and shoulders pattern bullish

The Head and Shoulders Pattern is a bullish technical indicator that can be used to predict future stock prices. The pattern consists of two peaks, or shoulders, in the stock’s price chart. The first peak is usually higher than the second, indicating that investor confidence (and therefore demand) is increasing.

Head and shoulders pattern entry

Ahead of the curve in stock market performance is a technical pattern that has been identified as the head and shoulders. The pattern consists of two upward sloping lines separated by a lower line, forming a “H” on the chart. The pattern’s appearance can be caused by strong underlying demand for stocks. When this demand is strong enough, it causes prices to rise above the upper line, or resistance, and then fall below the lower line, or support.

Types of head and shoulders pattern

The head and shoulders pattern is a technical indicator that can be used to predict the direction of the market. It is composed of two indicators: the head and shoulders pattern indicator (H&S) and the neckline pattern indicator (NPI).

The H&S indicator illustrates the expansion of the head and shoulders pattern, while the NPI shows whether or not a neckline has been violated. The presence of both indicators confirms a market trend.

The most common type of head and shoulders pattern is an upward one. When this pattern is formed, prices rise sharply for a brief period before declining again. This upward trend often coincides with an upturn in economic activity, which leads investors to believe that stocks are overvalued and ready for a fall.

When interpreting the H&S signal, traders should keep in mind that it has a tendency to fail before confirming a trend. This means that it’s important to trade with caution when using this indicator. If you see the H&S signal form but fear that it might not be legitimate, wait for confirmation before making any decisions.

Traders who want to avoid getting caught in a head and shoulders trade can use the NPI as their primary filter

Head and shoulders pattern rules

The head and shoulders pattern is a technical analysis pattern that indicates a potential for price increases. The pattern consists of a peak in price followed by a decline, with the shoulders representing the support level that helps to maintain the uptrend. When followed correctly, this pattern can provide traders with valuable information on where the market is headed.

Head and shoulders pattern breakout

The head and shoulders pattern can refer to a variety of technical indicators, but the most common one is the 30-day moving average. This indicator uses the closing prices of a security or basket of securities to calculate the average price over a period of 30 days.

When the 30-day moving average crosses above the top of the head and shoulders pattern, this indicates that the market is expecting strong growth in that security or basket of securities. Conversely, when the 30-day moving average falls below the bottom of the head and shoulders pattern, this signals that investors are pessimistic about future growth prospects for that security or basket of securities.

There are several other technical indicators that can be used to identify when a security or basket of securities is experiencing strong or weak growth, but the 30-day moving average is by far the most popular.

Conclusion

The Head and Shoulders pattern is a popular trend that can be used to create a variety of different looks. It can be worn as part of a casual or formal outfit, and can add an element of sophistication to any wardrobe. If you are looking for a versatile pattern that can be tailored to fit any style, the Head and Shoulders pattern is worth considering.

Leave a Reply